The United States is about to undergo the largest transfer of wealth in history, with over $40 trillion being handed down within families by 2050[1]. While the redistribution of assets from one generation to another is not new, what is distinct now is the magnitude of the movement as well as the speed with which it is happening. Such movement presents financial planners with the challenge of not only helping a large number of clients prepare their portfolios for retirement and estate planning, but also to potentially lose a large amount of assets under management (AUM).

Loss of AUM by individual advisors and their companies through inheritance from client to family is a clear issue. The vast majority of inheriting family members do not continue with the same planner as their previous generation. In fact, only 2-10% of children may stay with the same financial planner upon inheritance[2]. Another trend is that only about 30% of advisors actively seek clients under the age of 40[3]. Such a large movement of clients and assets, combined with the potential of growth in a relatively untapped market, creates an opportunity for advisors to not just maintain clients within families but also reach a population segment who are entering their prime earning years.

Millennials, broadly defined as those between the ages of 23 and 38, number 73 million as of 2019 and are about to outnumber baby boomers[4]. Overall, this generation may be one of the more educated in US history[5], but they may still lack basic financial literacy as compared to those over 60[6]. Younger generations are also observed to be less likely to access financial planners. In one summary of research, millennials may be hesitant to access professional support due to potential fees and costs, fear, or the belief that they can do it themselves[7]. The rise in robo-advisors is also a challenge due to their low cost and accessibility. Nerd Wallet, an online publisher and comparison service, listed ways to get “cheap or free financial advice” and placed in-person financial advisors last on the list[8]. Thus, the goal of bringing family members into client meetings would be threefold:

- Educate clients about the importance of educating the next generation

- Build relationships and trust with family members

- Educate younger earners of the importance of early financial planning even as they pay off debt, buy houses, and otherwise begin to build their own estates.

Why Advisors Should Consider Family Connection Planning Strategies

The concept for these strategies comes as much from my personal experience as the trends described. My father died when I was in middle school and left my mother and me with the household responsibilities. As an only child of a mother with health challenges of her own, I was brought into many conversations regarding our family’s finances and the trusts that were in place for certain contingencies. These experiences not only taught me the importance of financial literacy as way to support the stability of a family, but also brought me into contact with various financial specialists.

The professionals my mother and I interacted with included accountants, financial advisors, and insurance brokers. Of the three, I have continued to work with two of them. Their knowledge of my family background and of my current family make up have made them invaluable resources for my nuclear family as well as my mother. Building trusting relationships between an advisor and client takes time and the experience I had throughout my teen and early earning years were critical in providing a pathway for this process. There is also the basic concept that inertia, the tendency to resist movement or change, is real. As it was for me, many people will see more in the gains of staying the course than wanting to take on the pains involved in having to migrate personal information, papers, and accounts to another person or company and begin the trust process all over.

What Advisors Stand to Gain

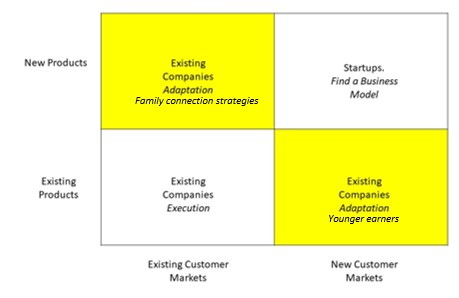

The figure below shows that by adopting family connection strategies, advisors can bring new products (ex. deeper family planning, trusts, wealth transfer strategies) to existing customers while also marketing existing products and services to new customers (i.e. younger earners).

In order to be able to bring families together for any sort of informational or planning meeting, the following core principles need to be clear to everyone, especially the current client:

- Maintain trust with clients (grand/parents) by maintaining confidentiality and putting their interests first.

- Maintain trust with clients (grand/parents) by allowing them to decide what information is shared and to control the scope and direction of how family members may be brought into the planning process.

- All clients’ contributions and assets are valued and respected.

The added value to clients, and their families, of participating in family connection planning strategies include:

- Reduce the pains people feel when discussing inheritance.

- Reduce the challenges people have to undergo when someone passes away.

- Increase the awareness of the importance of financial advising and current services and products to younger generations within families.

- Create mechanisms and communication pathways that allow families to engage in the process even if not physically together.

Family Connection Planning Strategies

Each advisor and company will need to determine the exact process and tools that will be used in bringing clients and their families together. Suggested starting points include:

- Annual/Semi-Annual “Family” Meetings: These meetings would be client-led, preferably in-person, but may also be virtual.

Goals:- Build relationships and trust with family members.

- Maintain trust with clients (grand/parents) by allowing them to decide what information to share and control the meetings.

- Wealth Worksheets: A platform to allow clients to organize any information they wish to share with designated family members. The selected information may be hard copy, electronic, or online and viewable with a password on a clients’ personal portal.

- Such an approach would also allow family members to communicate asynchronously outside a meeting.

- Estate Growth Guides: Most advisors and their companies already provide information about estate planning and trust in-person and on the website. Estate Growth Guides would differ in that they would help to educate the client on the importance of educating their grand/children about financial literacy. These guides would also contain information that is pertinent to younger earners, such as debt, real estate purchases, and early-career investing.

In the end, the goal is to increase the touchpoints between the advisor and client as well as support families with planning important financial decisions before they may be needed. This becomes a win-win-win for the client, the family, and the advisor!

[1] Rusoff, J.W. (2016). How advisors can stop losing clients’ heirs as clients. Retrieved from: https://www.thinkadvisor.com/2016/03/01/how-advisors-can-stop-losing-clients-heirs-as-clients/?slreturn=20190816213631

[2] Rusoff, J.W. (2016)

[3] Mathews, J. (2019). How advisors are missing out on millennials. Retrieved from: https://www.financial-planning.com/news/are-financial-advisors-ignoring-millennial-clients.

[4] Fry, R. (2018). Millennials projected to overtake Baby Boomers as America’s largest generation. Retrieved from: https://www.pewresearch.org/fact-tank/2018/03/01/millennials-overtake-baby-boomers/.

[5] Fry. R., Igielnik, R., & Patten, E. (2018). How Millennials today compare with their grandparents 50 years ago. Retrieved from: https://www.pewresearch.org/fact-tank/2018/03/16/how-millennials-compare-with-their-grandparents/.

[6] Zoominfo. (2018). The top 5 target markets for financial advisors. Retrieved from: https://blog.zoominfo.com/target-markets-for-financial-advisors/.

[7] Zoominfo. (2018)

[8] Jackson, A-L. (2019). How to get cheap or free financial advice. Retrieved from: https://www.nerdwallet.com/blog/investing/free-financial-advice/.