The S&P 500 and other major US indexes are hitting fresh all-time highs every week, despite the near-term uncertainties resulting from the potential impact of COVID-19 related economic effects unprecedented fiscal and monetary easing. It is only natural, if not wise, that investors feel a bit hesitant about the stability of their portfolio should a sizable correction were to take place in sooner rather than later.

Meanwhile, since timing the market is one of the most unproductive and possibly harmful tasks that both individuals and professionals devote time to, the best approach to protect your portfolio from facing a sharp drawdown is to follow some simple strategies that do not involve complex technical analysis.

In the following article, I will describe some strategies in case you feel it is time to adopt a more cautious approach for your investments.

Strategy #1 – Incorporate defensive stocks into your portfolio

The consumer defensive sector of the market is comprised of companies that tend to fare well during times of economic distress. These include companies involved in consumer staples, such as manufactured goods, grocery stores, and liquor/tobacco.

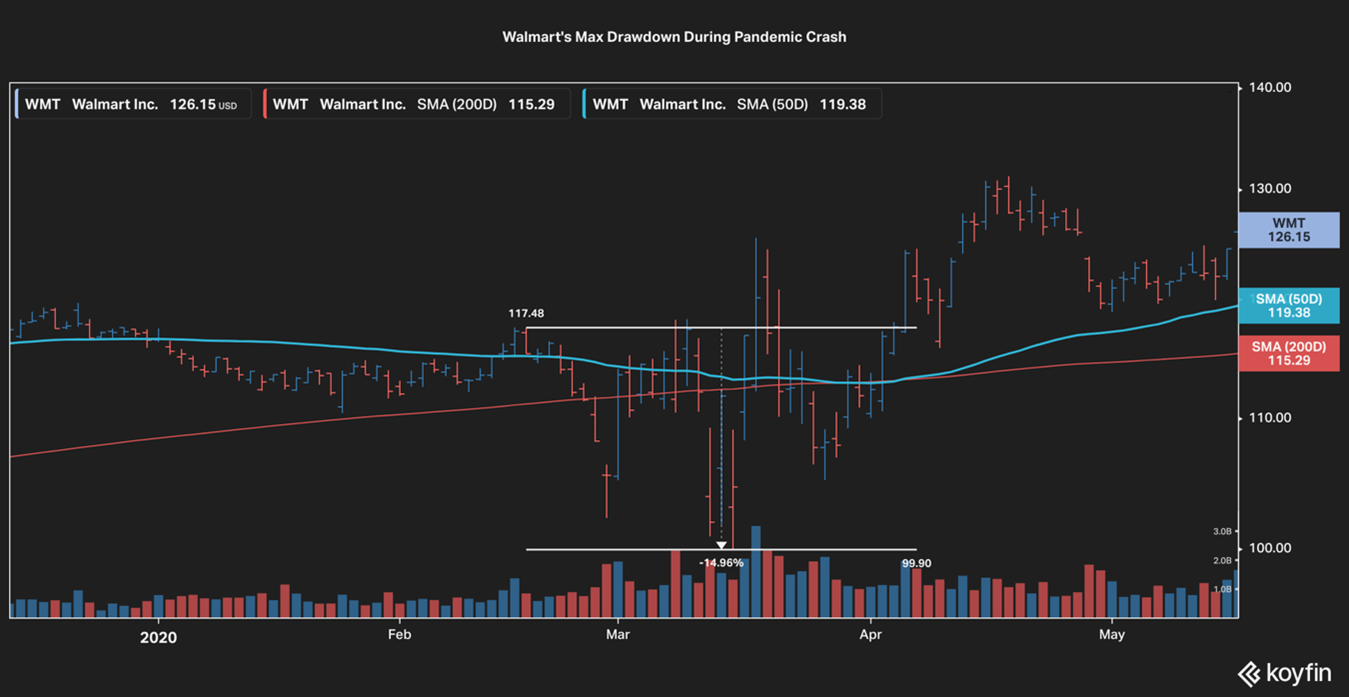

One interesting defensive stock is Walmart (WMT), a company that during the market downturn of February-March 2020 saw its share price decline by just 15% while other stocks lost more than half their value.

The reason why Walmart faced such a limited drawdown during the crash is that people will still need to buy groceries and other household goods during a pandemic. Thus, the company’s employees, vast supply chain, and e-commerce and brick-and-mortar operations would be functioning at the same, if not higher, levels, keeping the company stable. Unlike the airline, hotel, or restaurant sectors which faced significant, and long-lasting losses.

By incorporating defensive stocks such as Walmart into your portfolio you can limit the drawdown that the value of your account will face during times of distress. However, you should also keep in mind that defensive stocks tend to trade range-bound for long periods, which means that your gains could also be capped for a while.

Strategy #2 – Buy put options

A put option is a contract that gives you’re the right – not the obligation – to sell a certain security at a pre-determined price, known as the strike price, once the instrument reaches its maturity date.

Put options help investors in hedging against potential market downturns as they can make a bearish bet against a broad-market index such as the S&P 500 in case they are anticipating that a strong correction could be around the corner.

That said, this strategy is a bit expensive as you have to pay a premium for buying options contracts.

Here’s an example of how this strategy would work. Let’s say you expect that the market will decline by about 10% (a normal correction) over the next 3 months. Based on that forecast, if you hold $10,000 in shares of an exchange-traded fund (ETF) that tracks the S&P 500 you stand to lose at least $1,000 of your investment.

If you would like to hedge your $1,000 from losing that much, you can purchase a $411 July 16th put option on the SPDR S&P 500 ETF (SPY). This contract is currently valued at $13.39 per contract and you have to purchase a minimum of 100 contracts. This transaction would cost you $1,339 plus commissions.

Now what? If the market goes down from its current level during those 3 months, your put option will increase in value and those gains will offset a portion of the losses your S&P 500 ETF will face as a result of the downturn.

Strategy #3 – Liquidate some of your riskier holdings

This strategy has two upsides. First, you can hedge your portfolio against the sharp drawdowns that riskier stocks – often known as high-beta stocks – could face during a correction.

Second, you could use the cash you’ll have at your disposal to either re-enter those positions at a more advantageous price point in the future or you could buy other attractive stocks at lower prices as well.

Of course, there is a downside: you will be selling stocks that could continue to go up in value after you have sold them.

Bottom line

As you can see, none of these three strategies is perfect since each has a potential downside.

You should implement the one(s) that make(s) you feel the most comfortable and match your risk tolerance. Think carefully about how certain you are of your stock market “predictions” and how much money you want to protect and/or spend hedging your portfolio.

Disclaimer: This article presents the ideas and opinions of the author and should not take the place of personal research or advice from a professional finance or wealth manager. All investing decisions carry risks and can never be completely mitigated.

About the author:

Jasdeep Singh is an MBA student at the University of Connecticut and Director of Operations and Marketing for 3BC, “The Cannabinoid Company.”

Follow him on: